best buy 401k withdrawal

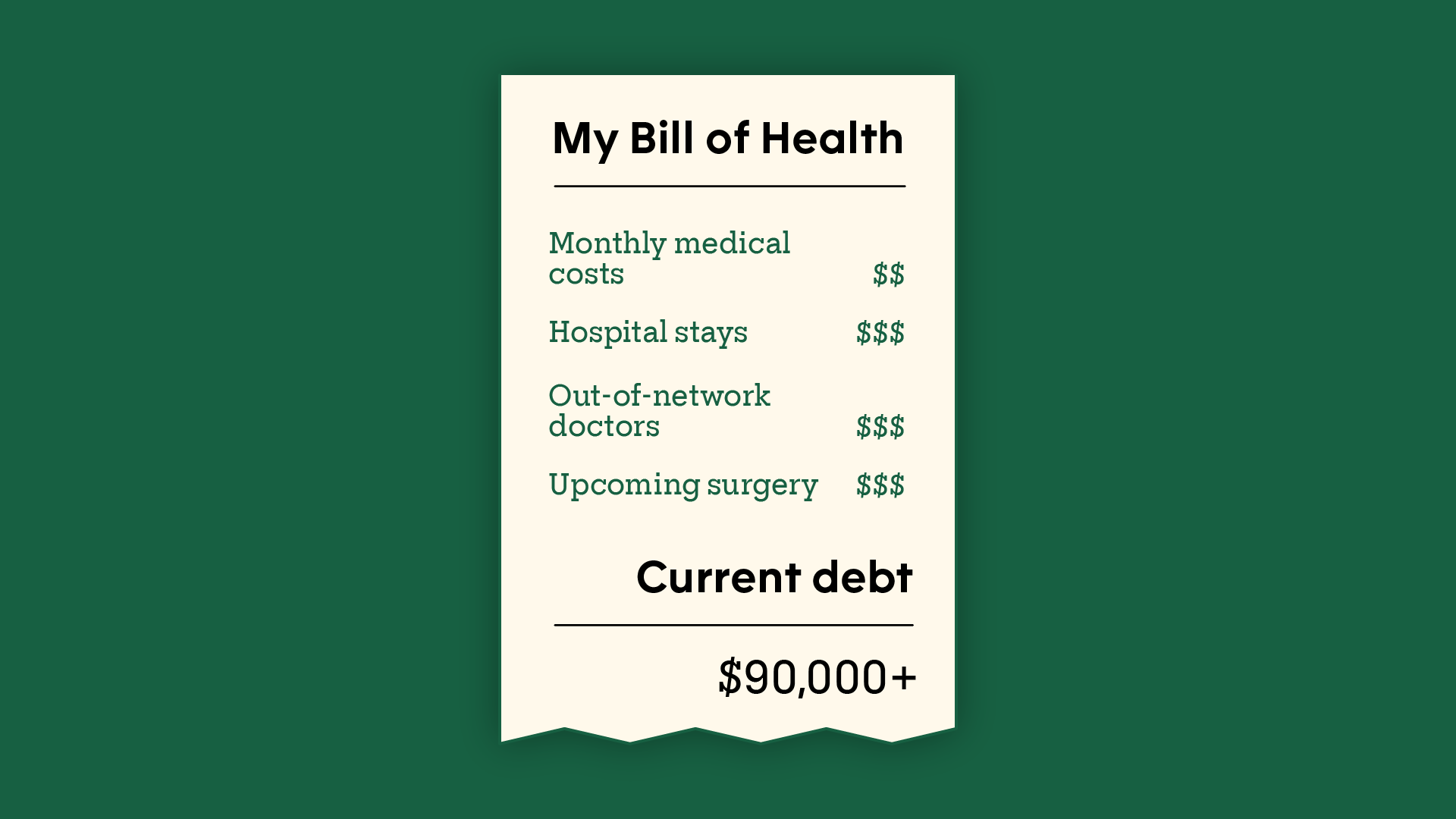

Take required minimum distributions to avoid penalties. Removing funds from your 401 k before you retire because of an immediate and heavy financial need is called a hardship withdrawal.

Can I Withdraw Money From My 401 K For Medical Hardship Goodrx

The rules for accessing your money are determined by your employers plan.

. However a 401 k withdrawal for a home purchase is generally not the best move given there. People do this for many reasons including. Best buy 401k withdrawal 401k Withdrawal Rules For Home Purchases 2021.

Home 401k best buy withdrawal. You can roll over the funds from your Best Buy 401 k into the new employers plan and effectively pay no. If for some reason you cannot afford to pay back the loan then the 401k is used to.

Best buy 401k withdrawal 401k Withdrawal Rules For Home Purchases 2021. I know BBY setup some special provisions for financial hardship and such. Consider these retirement account withdrawal strategies.

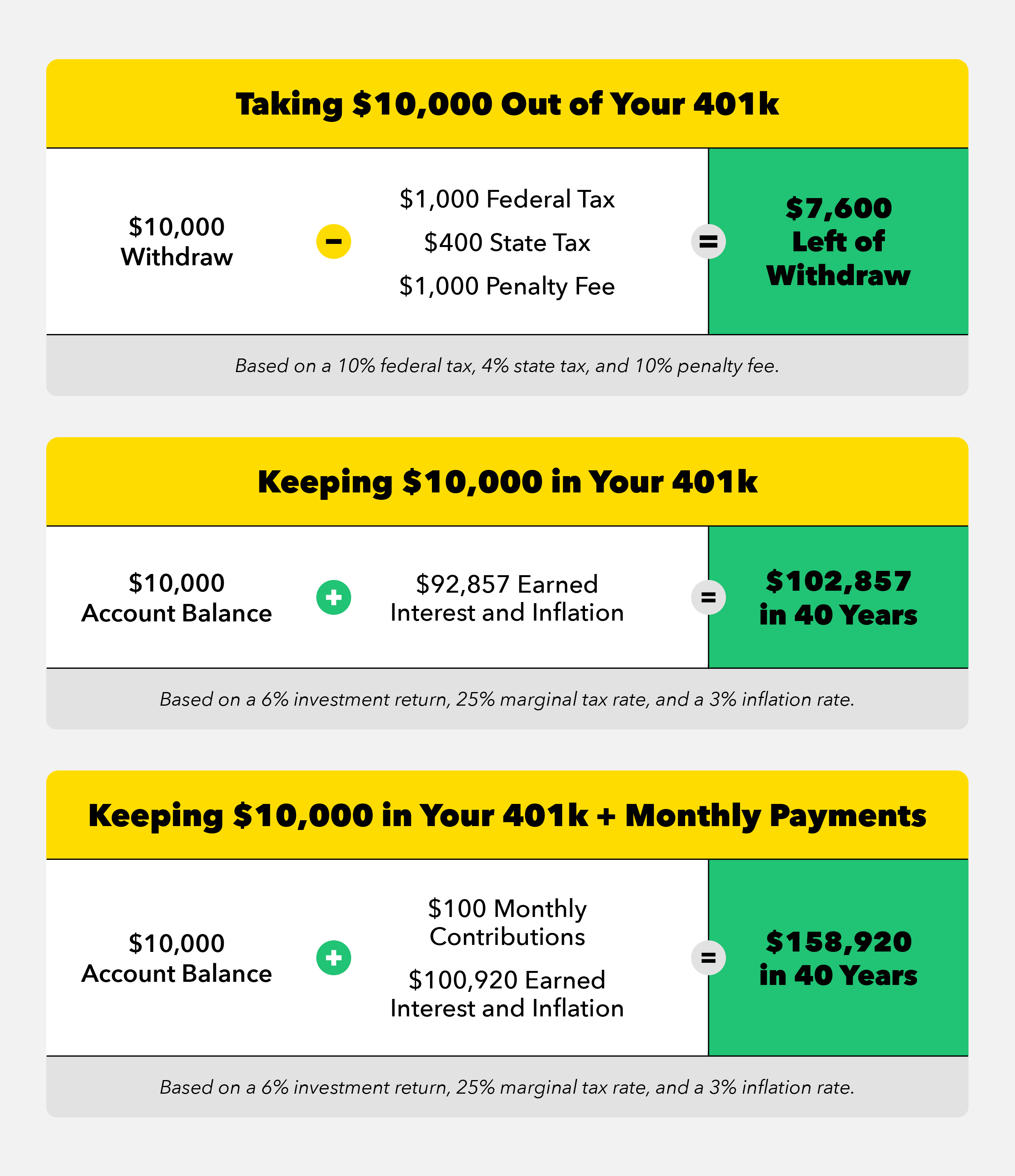

Best buy 401k withdrawal Monday July 11 2022 Edit. You cant take loans out from old 401 K accounts. In this hypothetical withdrawal scenario a total of 23810 is taken from the account so that 37 8810 of the withdrawal is set aside for taxes and penalties and the.

Under the SECURE Act employees can withdraw up to 5000 from a retirement plan to cover the birth or adoption of a child penalty-free. Enter username and password to access your secure Voya Financial account for retirement insurance and investments. Withdraw funds in years.

Usually when you get to your new employer they might have a 401 k option as well. Just seeing if anyone has pulled from their 401K during the pandemic. When you are age 55 through 59 12 you can begin to withdraw from your 401 k without penalty.

Removing funds from your 401 k before you retire because of an immediate and heavy. Whether you can take regular withdrawals from your 401 k plan when you retire depends on. Did you just have to.

A 401k loan may be an alternative to a withdrawal as long as you can afford to make the payments. Rachel Hartman April 7 2021. Generally speaking a 401 k can be used to buy a house either by taking out a 401 k loan and repaying it with interest or by making a 401 k withdrawal which is subject.

Walmart 401k Hardship Withdrawal With Merrill Lynch Irs Tax Rules Crd. Birth or adoption of a child.

401k Early Withdrawal Calculator How Much Will It Cost To Cash Out

What Is The 401 K Tax Rate For Withdrawals Smartasset

Accessing 401 K Assets Early Know The Options And The Potential Hurdles Ascensus

How To Withdraw Money From Your 401 K Smartasset

How Do You Withdraw Money From A 401 K When You Retire

Annuity Rollover Rules Roll Over Ira Or 401 K Into An Annuity

Should I Buy An Annuity From My 401 K 2022

Tapping Your 401 K Is Now The Right Time To Do It

Legitimate Reasons To Withdraw Funds From A 401k Or Ira

401 K Withdrawal Rules Early Withdrawal Penalty Exceptions

401k Withdrawal To Buy A Home Online 58 Off Amico Tours Com

Withdrawing From Your Roth Ira Know The Penalties And Taxes You Could Incur Cbs News

:max_bytes(150000):strip_icc()/how-to-take-money-out-of-a-401k-plan-2388270-v6-5b575ead4cedfd0036bbfb6f.png)

How To Take Money Out Of A 401 K Plan

Can I Use My 401 K To Buy A House Updates For 2022

Cashing Out A 401 K Due To Covid 19 Consider These Things First Nerdwallet